Home | Green van insurance | Pick up insurance

Your pick up is more than just a vehicle, it's a versatile workhorse that can serve both your trade and leisure needs.

At The Green Insurer, we understand the unique requirements of pick up owners, which is why we offer three types of insurance that not only protect your pick up but also reward you for driving greener.

Why choose our pick up insurance?

Great rewards for every mile

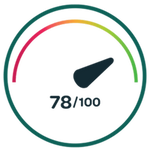

Drive with peace of mind knowing that your journeys are turning into valuable rewards. Your Green Driving Score reflects your eco-friendly driving habits, earning you rewards along the way.

Effortless carbon offsetting

No extra steps needed. We automatically invest in sustainable projects to offset the carbon emissions from your pick up.

Track and improve your Green Driving Score

With The Green Insurer app, you can monitor your Green Driving Score and see the positive impact of your driving habits.

Van insurance benefits

-

Earn Green rewards

You earn Green rewards based on your Green Driving Score and the number of miles you’ve driven.

We call these reward points Green rewards.

You can then exchange your Green rewards for eGift cards in our exclusive rewards portal.

-

Exclusive rewards portal

Our exclusive rewards portal is packed with discounts, offers and freebies.

We've carefully selected brands that we believe may be of interest to you.

-

The Green Insurer app

In The Green Insurer app you can see how many Green rewards you’ve earned, what projects are used for your carbon offsets and your Green Driving Score.

-

Green Driving Score

Your Green Driving Score is calculated using acceleration, braking, cornering, mobile phone use and speed to measure how green (fuel efficiently) you’re driving.

The number of miles driven is also used to calculate your carbon offsets and the number of Green rewards you’ll earn for driving fewer miles than anticipated.

-

100% of your carbon is offset

We then offset these miles using high-quality independently accredited carbon offset projects.

-

Carbon offset projects

- Mai Ndombe – Reducing forest and biodiversity loss in Democratic Republic of Congo

- Keo Seima – Reducing deforestation in Cambodia

- Rimba Raya – Peatland protection in Borneo

- Find out more about these projects

Pick up insurance: What it covers and why you need it

Your pick up is more than just a vehicle - it's a vital part of your work and lifestyle. Our pick up insurance ensures you’re covered, giving you peace of mind on every journey.

Pick up insurance cover levels

Comprehensive van insurance

Comprehensive van insurance is the highest level of cover. It covers you for damage to your van (including by fire) or if it is stolen.

Comprehensive cover also includes windscreen and glass damage.

You're also covered for claims made against you by other people for injury or damage to their vehicle or property.

Third Party, Fire & Theft (TPFT)

TPFT van insurance covers you if your van is damaged by fire or stolen, and if other people claim against you for injury or damage to their vehicle or property.

Third party

Third party van insurance covers you for claims made against you for injury or damage to other people’s vehicle or property.

It won’t cover any damage to your van.

Get a quote| Key benefits | Comprehensive | TPFT | Third-party |

|---|---|---|---|

| Injury to others | |||

| Damage to other people’s property | |||

| Up to 90 days cover in European Community countries | |||

| Theft of your van | |||

| Fire to your van | |||

| Courtesy van during repair | |||

| Damage to your van | |||

| Glass damage | |||

| A new van replacement if your van is stolen or written off (for vans less than 1 year old) | |||

| Courtesy van during repair | |||

| Replace locks if keys are lost or stolen | |||

| Medical expenses | |||

| Hotel expenses | |||

| Alternative transport | |||

| Personal Accident cover | |||

| Personal belongings | |||

| Uninsured driver promise | |||

| Tools cover |

All cover and benefits may be subject to acceptance criteria, terms and conditions.

Check your quotation and policy documents for confirmation of cover.

Get a quoteOptional extras with our van insurance policies

Breakdown cover

Breakdown insurance gives you up to one hour of breakdown assistance in the event of a fault or failure that prevents you from driving your car.

If the vehicle cannot be repaired in the hour, it will be taken to either a garage or to a destination of your choice depending on your level of cover.

Breakdown cover is underwritten by AmTrust AmTrust Speciality Limited.

| Key benefits |

Roadside breakdown with local recovery £38 |

Roadside breakdown with local recovery and Homestart £45 |

Roadside breakdown with UK recovery and Homestart £70 |

|---|---|---|---|

| Unlimited call outs* | |||

| Covers anyone driving your car | |||

| Misfuelling cover** | |||

| Roadside assistance with local recovery | |||

| At home assistance | |||

| National recovery |

*Unlimited call outs up to a combined maximum total cost of £10,000 annually

**Misfuelling cover within the UK only.

Documents

- Policy Booklet

- Roadside breakdown with local recovery IPID

- Roadside breakdown with local recovery and Homestart IPID

- Roadside breakdown with UK recovery and Homestart IPID

Motor legal expenses

Motor legal expenses from £24 covers you for up to £100,000 of legal costs in relation to a non-fault motoring incident, for:

-

Uninsured loss recovery

To recover losses following an accident where someone else is responsible in the UK.

-

Motor prosecution defence

To defend an alleged motoring offence if you have received a court summons.

-

Motor vehicle consumer disputes

To pursue compensation following a breach of an agreement relating to the sale, purchase, servicing, repair, testing, hire or hire purchase of the vehicle.

-

Telephone legal helpline

Advice relating to any private motoring matter.

Legal expenses cover is administrated and arranged by Lexelle Limited on behalf of Financial and Legal Insurance Company Limited.

Documents

Guaranteed hire van

If your van's been stolen, written off or being repaired by our recommended repairer service, we'll guarantee you'll get a hire van.

You'll be given a suitable replacement vehicle for up to 14 days or 28 days depending on your cover level.

Hire van is administered and managed by Legal Protection Group Limited.

- Guaranteed hire van for 14 days - £20

- Guaranteed hire van for 28 days - £35

Documents

FAQs

Premium Finance fees

We have partnered with Close Premium Finance to provide our customers an affordable option to pay for their insurance.

Fees

- APR rate is 25.5%

- Interest rate 10.7%

- Default fees £25

What is no claims discount?

This is a discount insurers give you for the number of years you have been driving as a policyholder without making a claim against your own policy. It is important to remember that if you make any non-glass claim against your own policy, even if the accident was not your fault, this will still be counted as a claim.

What is a claims free driving discount?

Claims free driving only applies when no claims discount isn't available.

Some insurers may give you a discount if you have been driving for a number of years without a claim, but it’s not been under your own insurance policy. For instance, you may have been a named driver on someone else’s van insurance policy, or been driving a company car. You will need to supply proof of this to get the discount.

What is an excess?

If you have a claim under your van insurance policy this is the amount you will have to pay towards the overall cost. The amount may be different depending on the claim - for instance the amount you have to pay for accidental damage may be different from what you pay towards a claim where the is only glass damage. Your insurer will set the excess level, which is the lowest amount you can agree to, but you can choose to apply an additional voluntary excess to reduce your premium.

Can I drive other cars under my policy?

This can vary from van insurance policy to policy, so please check very carefully before relying on this cover - it will be shown on your van insurance certificate. The “driving other cars” cover that applies to some policies is designed if you need to drive another van in an emergency. It doesn’t cover any damage or loss to the vehicle you are driving.

Driving other cars cover only applies to the policyholder and not any named drivers.

What are green parts?

Undamaged parts that have been safely removed from another van to be recycled and fitted to another van when being repaired are referred to as green parts. At The Green Insurer we are keen to use green parts wherever possible, and by taking out a van insurance policy with us you are agreeing them being used where available. We like Green Parts because they avoid the carbon costs of making a new part and reduce wastage generated by disposing of undamaged parts. Wherever green parts are used by one of our insurers they are guaranteed for as long as you own the car, excluding general wear and tear.

What happens when the policy ends?

Once your policy has ended, you will have access to your account via The Green Insurer app and portal for thirty days, it can take up to 24 hours from the policy ending before the app stops recording trips.

What if I go over my miles?

If it looks like you are going to over-exceed your milage you’ll be sent a warning message which will allow you to make an adjustment to increase the mileage on your policy so that you don’t void your van insurance policy.